Grocers, c-store owners, and other retailers have experienced a challenging labor market recently. COVID-19 impacted the labor market in many ways. Store owners are experiencing a shortage of employees, higher turnover rates, and difficulty hiring. 3 ways store owners can help alleviate these challenges are…

2017 Regional C-Store Trend Update

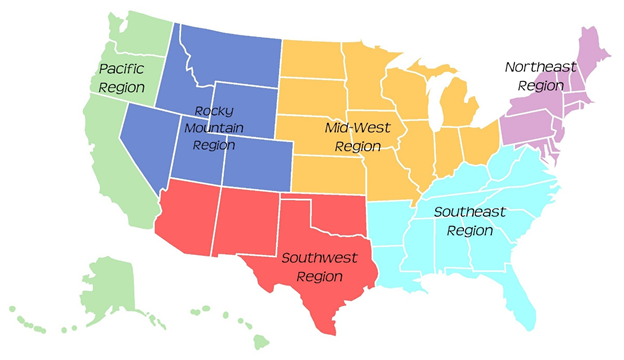

We’ve written posts before about the importance of making sure that your store is ready to serve the specific customers in your area. To do this, you should not only understand the interests of your customers, but also the challenges to seeing success at your store’s location. While you can look at the trends in your city or even state, you should probably start by just looking at what’s happening in the region of the United States where you’re located. In every region in the United States, there are ways that c-stores can easily win with customers as well as ways that the industry needs to overcome and improve. NACS did the research on trends throughout six regions of the country, and we’d love to share the findings.

Findings from the Northeast & Midwest

- C-stores in the Northeast are doing very well in foodservice

- If you’re in this region and haven’t invested in foodservice yet, you should. Customers are getting used to having access to hot and cold prepared foods at their local c-stores.

- The Northeast saw a large decline in cigarette sales in 2017

- Rising taxes on tobacco products are making cigarettes a much less profitable category. If you’re in this region, or another place where tobacco taxes are increasing, make sure you are making up for the lost profit in other areas.

- The Midwest sees more sales of perishable groceries than any other region in the country.

- If your c-store is in the Midwest, you should evaluate your distribution and see how you can offer more perishable groceries like fruits and vegetables.

- C-stores in the Midwest index below the national averages for 4 out of 5 foodservice categories.

- More stores in the Midwest need to invest in a foodservice program, whether it be dispensed beverages or prepared sandwiches.

- In both the Midwest and Northeast commissary sales are down.

- Invest more in foodservice to win with customers in these regions, packaged goods are not where they are spending their money.

Findings from the Southeast and South Central Regions

- Retailers in the Southeast are seeing the benefits of a growing population

- More and more consumers are moving and settling in the Southeast, creating larger cities where more businesses can thrive

- The Southeast underindexes in foodservice compared to the national average

- More c-store owners in the Southeast need to take advantage of foodservice programs, as the region is missing a huge opportunity for new profits

- The Southeast is ahead of the national averages when it comes to commissary product sales

- While the other regions are struggling in this category, store owners in the Southeast are seeing continued success

- C-stores in the South Central region seen a decline in prepared foods and dispensed beverages in 2017, causing them to underindex for both food service profit share and sales

- The South Central Region (mainly Texas) is adjusting to post-fracking boom reality

- Consumers in this region are moving away due to the industrialization of the land

- While operating costs in the South Central region are still below the national averages, professionals in the industry are advising that store owners keep their eyes on the numbers

Findings from the Central and West Regions

- Although operating costs in the Central region are declining, the profit dollars are declining even faster

- The low number of stores in this region, paired with the difficult access to products is causing store owners and operators to suffer

- Even fuel consumption in the Central region has declined a great deal

- Retailers need to find ways to offset their loss in gasoline sales

- Operating costs in the West are increasing much faster than the profits that retailers are seeing

- C-store owners in the West need to focus on how to get the ideal consumer products and how to run a store consumers love for a much cheaper price

- The West region is becoming saturated with businesses of all kinds, especially

- New c-store locations are being opened in the suburbs, where there is still space and where consumers are migrating

- Wine knocked milk off the West regional top-selling categories in 2016

- C-store owners should be paying close attention to the wine selection in their stores and what consumers are looking for in that category

- The West saw an 8% growth in prepared food.

- Consumers in the West value a location to get quick fresh foods that they can enjoy on-the-go.